NIC changes – recruitment agency guide

Back in September, Boris Johnson announced a new tax to fund the NHS and adult social care in England. This will initially take the form of an increase in National Insurance Contributions from 6th April 2022. This will then become a stand-alone Health and Social levy from 2022.

Also changing from 6th April are the National Living Wage and National Minimum Wage. Then thrown into the mix is an increase in the Employees NIC threshold; the amount of money you earn before having to pay National Insurance. This was recently announced in the Chancellor’s Spring Statement and will come into effect from July.

As a recruitment agency, you may have staff on your own payroll as well as contractors working through umbrella companies.

Here’s a run-down of all these impending changes and what you need to consider for the various cohorts of your workforce:

NIC changes from 6th April 2022

For the 2022 / 23 tax year, the Health and Social Care (HSC) levy will be funded by an increase in National Insurance.

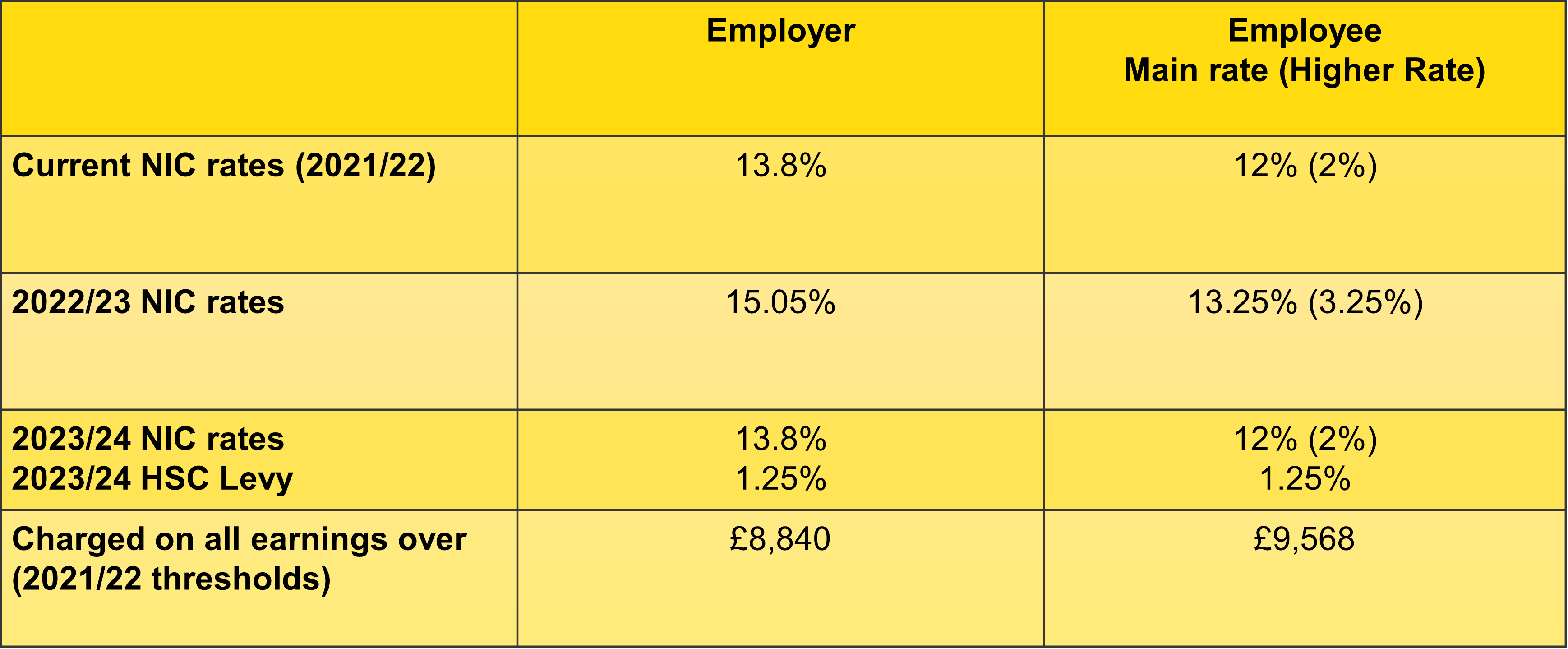

Employers NICs will increase by 1.25 percentage points, taking them from 13.8% to 15.05%

Employee NICS will also increase by 1.25 percentage points. This takes the rate up from 12% to 13.25% for earnings below the NIC Upper Earnings Limited, and from 2% to 3.25% for earnings above that limit.

HSC levy from 6th April 2023

From April 2023, HMRC plans to have the systems in place to collect this tax rise as a separate HSC levy, which will be paid through the PAYE system and shown on payslips.

Payslips will identify an employee contribution of 1.25% of before tax salary, while employers will pay 1.25%.

The way it is processed and paid will be similar to NIC payments.

Your internal and on-payroll staff

For internal staff and contractors on agency payrolls, you will have to pay the increased rate of Employers NIC and apply the increased rate of Employees’ NIC from 6th April 2022.

You will need to budget and plan for the impact of the NIC increase on your staff and PAYE workers’ salaries as well as having to pay the Employers NI increase.

During the 2022 / 23 tax year, HMRC is asking employers to include the following message on payslips:

“1.25% uplift in NICs, funds NHS, health & social care”.

Existing NIC reliefs will apply for:

- Employers of apprentices under 25

- Employees under 21

- Ex-armed forces veterans

If you qualify for the £4000 (£5000 from April 2022) annual Employment Allowance, this can be used against the new HSC levy.

Rate increases at a glance

Umbrella company workers

For workers you are paying through umbrella companies, the increase in Employers’ NI (and subsequently the employer’s contribution of the HSC levy), is an additional employment cost.

Like existing Employers NIC and the Apprenticeship levy, this comes off the total assignment rate – which is the rate paid to the umbrella company by the agency.

Some agencies have already indicated that they will be increasing assignment rates to cover the additional Employers NIC in order to mitigate the impact on the work’s take-home pay. Some are absorbing this cost themselves, while others are negotiating higher contract rates with their end clients: now is the time to consider your approach and having these discussions with clients.

The increase in Employees NIC will be shown on payslips as a standard employment deduction until April 2023, when it will be identified separately as the HSC levy.

Other considerations

As well as potential salary and assignment rate increases to absorb some or all of the cost of the HSC levy, there are a couple of other considerations for agencies to factor in.

- Updating and upgrading payroll software

This is a further cost consideration, as well as the additional resource of staff time and training on new or updated systems.

- Communication and education

This includes communication with internal staff and contractors. Liquid Friday will be happy to help our agency partners with these communications, and helping workers understand the HSC levy and how it is calculated.

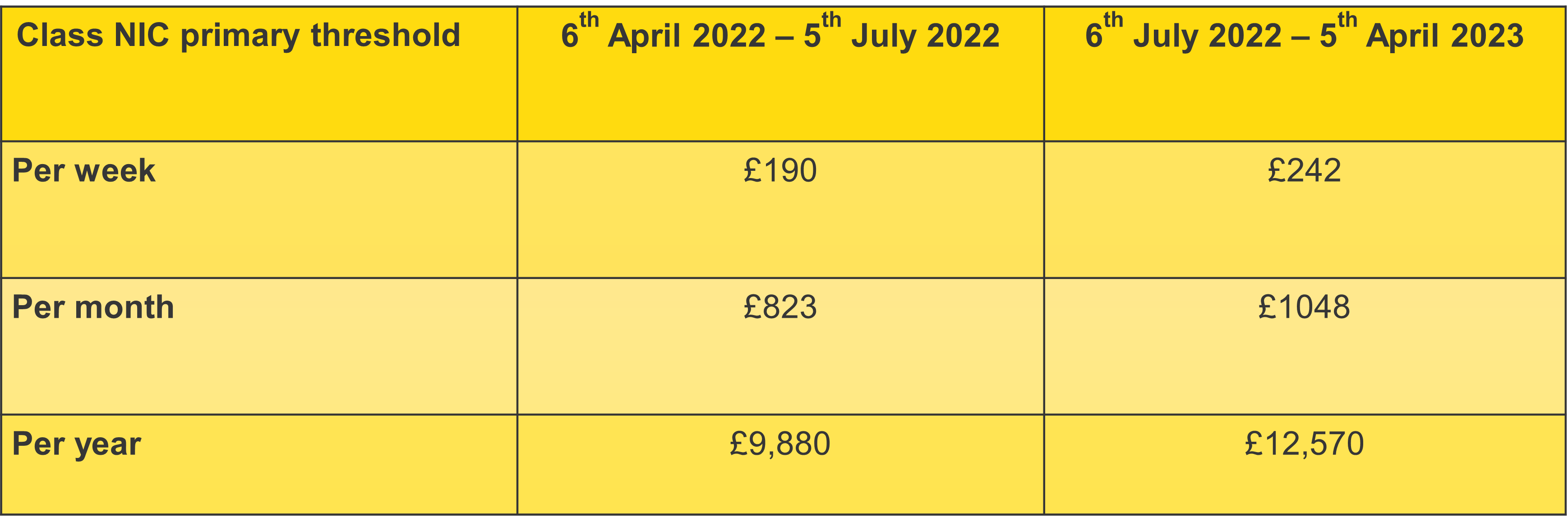

NIC threshold from July 2022

The government did not bow to calls for April’s NIC increase to be scrapped amid the cost of living crisis. However, in the Spring Statement of 23rd March, Chancellor Rishi Sunak announced a measure to mitigate the impact on people’s pockets.

Part way through the tax year on 6th July 2022, the primary threshold for Class 1 NIC will now change, bringing it into line with the personal allowance for income tax.

Employees NIC threshold change at a glance

Changes to the NMW / NLW

Also happening in April is a rise in the National Living Wage for those aged 23 and over, and the National Minimum Wage paid to younger workers.

Here are the increases at a glance:

- National Living Wage for over-23s: From £8.91 to £9.50 an hour

- National Minimum Wage for those aged 21-22: From £8.36 to £9.18

- National Minimum Wage for 18 to 20-year-olds: From £6.56 to £6.83

- National Minimum Wage for under-18s: From £4.62 to £4.81

- The Apprentice Rate: From £4.30 to £4.81

Impact on umbrella company minimum rates

The NMW / NLW increase will have a knock-on effect on the minimum viable umbrella rate.

Some umbrella contractors will require an uplift in their umbrella assignment rate in order for the umbrella company to comply with NLW/NMW compliance.

Good umbrella company practice is to identify any such contractors and communicate this to agencies ahead of 6th April.

If other umbrella companies in your supply chain haven’t yet done this, get in touch with them as it could result in confusion and delays with the first payroll of the new tax year.

If you have any issues in this regard, get in touch with Liquid Friday and we’ll be happy to help!

Government guidance on the NIC changes can be found here.