CIS tax fraudster behind bars after 12 years on the run

A construction boss convicted of a £4.2m CIS tax fraud has finally been jailed after fleeing the country 12 years ago.

Thomas O’Connor was convicted of the fraud in 2006 but escaped to Ireland before starting his four and a half year prison sentence.

Bogus invoices and false CIS returns

With two accomplices, O’Connor carried out a large-scale subcontractor fraud between September 2002 and December 2004.

As construction firm directors, the trio created bogus invoices in order to make false returns through the Construction Industry Scheme (CIS).

O’Connor was bailed following his conviction but failed to attend sentencing and a warrant was issued for his arrest.

Specialist HMRC officers finally caught up with him in Roscommon, Ireland, in 2011, which began the start of a lengthy extradition battle.

He appealed his case through the Irish courts and then the European Court of Justice, but was ultimately unable to block his extradition. He has now been returned to the UK to serve his sentence.

According to HMRC, O’Connor’s confiscation order currently stands at almost £8m, due to the interest on the original order of £4.2m, with the debt increasing by more than £960 every day.

If he is unable to pay back what he owes, he will face another five years behind bars.

HMRC – 1 Tax dodgers – 0

Gary Forbes, Assistant Director of HMRC’s Fraud Investigation Service said:

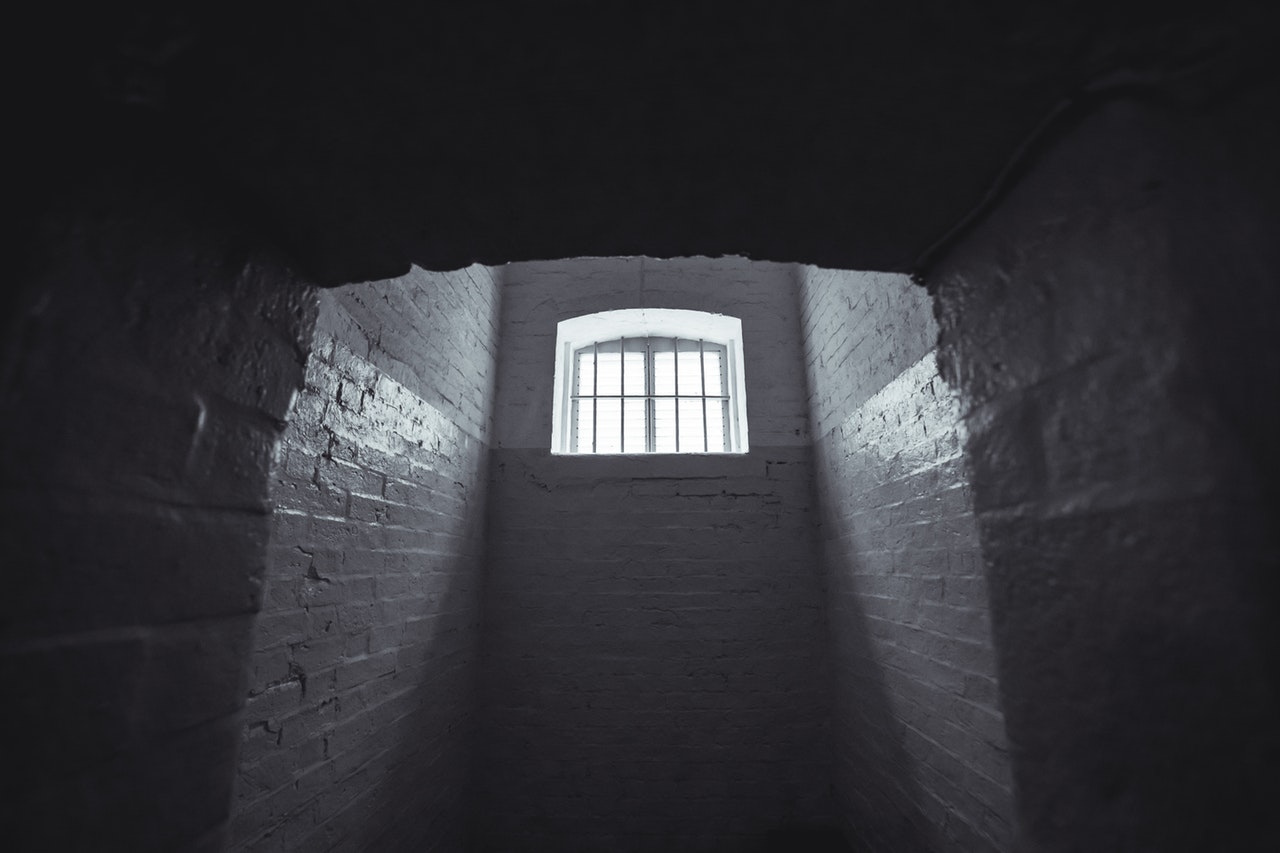

“We are delighted to be giving Mr. O’Connor the birthday present he deserves – a prison cell.

“He resorted to a series of desperate legal claims in a bid to cheat justice but he is finally where he belongs.

“O’Connor was behind a systematic attack on the public purse. He and his criminal partners stole the equivalent of the starting salary of 216 police officers.

“The stolen money paid for an off-the-books workforce and funded lifestyles they couldn’t legitimately afford.

“We will relentlessly pursue fugitives who think they can dodge UK justice. Our message to others like O’Connor is very simple. We will keep pursuing you, no matter how long it takes.”

Know your CIS supply chain

The O’Connor case highlights how important it is for recruiters to know who they are dealing with, as fraud can take place at any point in the supply chain.

Offering CIS payments as an alternative to PAYE or umbrella undoubtedly gives agencies a competitive advantage, but this has to be balanced against commercial risk, not to mention the added resource of verifying their self-employed status.

You can address both of these barriers by only paying your CIS workers through an FCSA accredited CIS provider, of which there are only currently three in the UK (Liquid Friday is one!)

Find out more about our CIS payroll services here